-

US indices slumped yesterday as Treasury yields jumped. S&P 500 dropped 1.83%, Dow Jones moved 1.51% lower and Nasdaq slumped 2.60%. Russell 2000 plunged 3.06%

- Indices from Asia-Pacific followed into footsteps of their US peers and also moved lower. Nikkei slumped 2.8%, S&P/ASX 200 moved 1% lower and Kospi dropped 0.7%. Indices from China traded lower

- DAX futures point to a lower opening of the European cash session

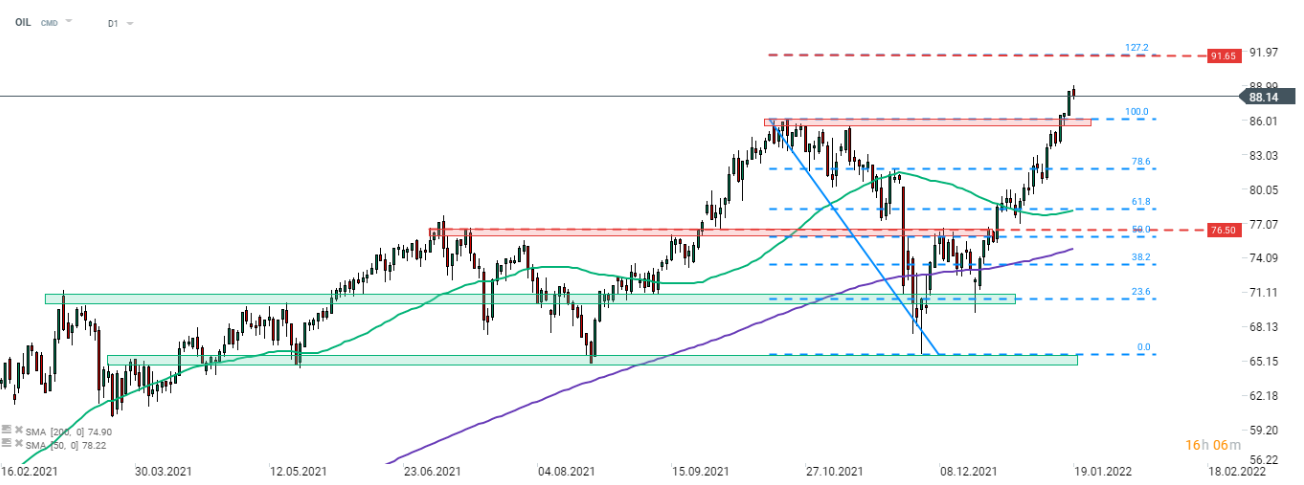

- Oil prices jumped after an oil pipeline between Iraq and Turkey was shut down following an explosion. Brent reached overnight high near $89 per barrel

- Members of Conservative Party want to trigger a confidence vote in Prime Minister Boris Johnson and oust him from the post

- White House spokesperson said that US administration has tools to combat rising oil prices and that it can engage with OPEC if needed

- According to OPEC monthly report, cartel does not expect Omicron or tighter monetary policy to derail oil demand

- According to Telegraph report, UK authorities will lift Covid restrictions today

- Precious metals trade mixed – gold trades flat, silver gains while platinum and palladium drop

- JPY and NZD are the best performing major currencies while USD and CAD lag the most

- Cryptocurrencies trade slightly lower. Bitcoin dropped below $42,000 while Ethereum tests $3,100 area

Trade Responsibly. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Forextk LTD does not provide services to residents of the USA, Japan, Canada, Australia, the Democratic Republic of Korea, European Union, United Kingdom, Iran, Syria, Sudan and Cuba.

+35726030417

+35726030417 support@Forextk.com

support@Forextk.com Android app

Android app