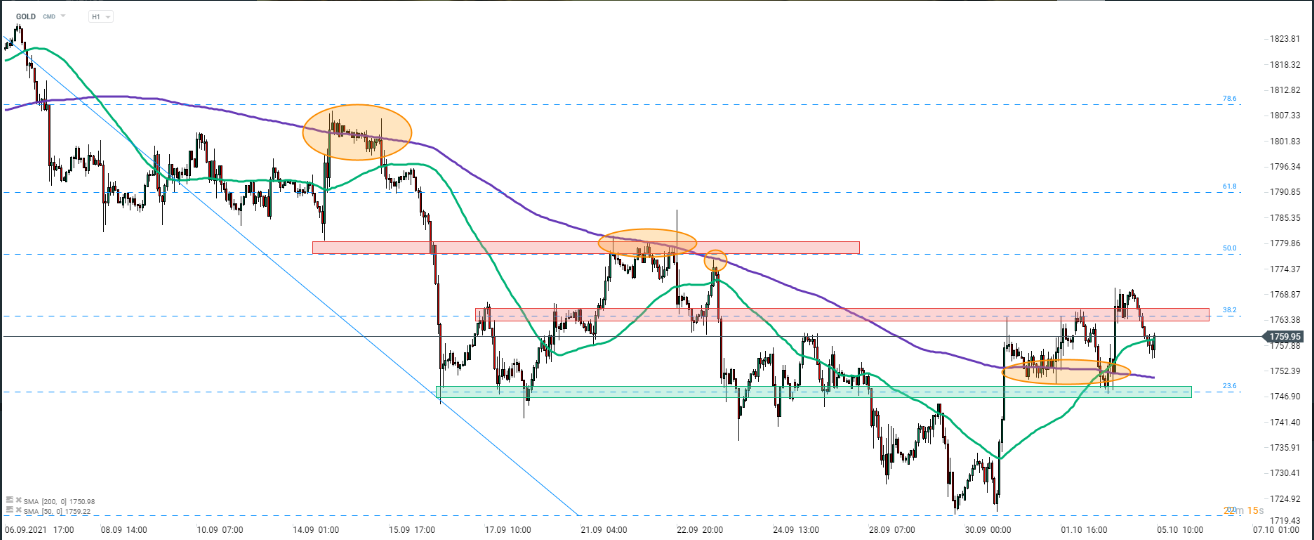

Volatility on the precious metals market spiked recently providing a wild ride for gold traders, especially this week. Gold has been moving higher since Thursday last week with gains being fuelled by mounting concerns over inflation and growth outlook. However, gold struggled with breaking above the 38.2% retracement of the downward move launched at the beginning of September ($1,765). A break above was delivered yesterday during the European session but it has been almost completely erased today as the US dollar strengthened and US Treasury yields increased.

A look at GOLD from a technical point of view shows that while precious metal has been trading in a downward move for a month, it has finally managed to break above the 200-hour moving average (purple line). This moving average has acted as a technical resistance over the past month and limited upside for GOLD therefore a break above makes the outlook somewhat more bullish. Moreover, the same moving average was tested twice later on, this time as a technical support, and bulls managed to defend it. As long as the price sits above it, buyers seem to be in advantage. Should we see a recovery from today’s drop and a break back above the aforementioned 38.2% retracement, the next target to watch will be 50% retracement at around $1,778.

+35726030417

+35726030417 support@Forextk.com

support@Forextk.com Android app

Android app