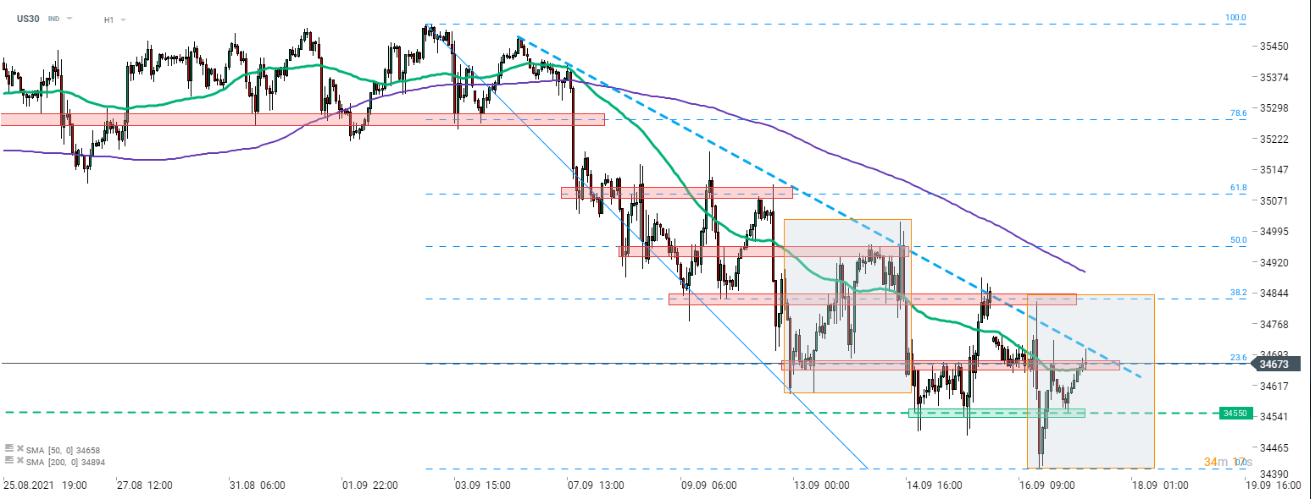

European markets trade mostly sideways this week as investors look for a trigger for the next big move. However, it was not the case for every US index. Dow Jones (US30) has been steadily moving lower since the beginning of September and this week was not different. Index broke below the 34,550 pts area yesterday and reached the lowest level since July 21, 2021. While the index recovered from these lows, a bearish bias remains in the market.

US30 is currently testing a resistance zone marked with the 23.6% retracement of the ongoing correction. Note that a downward trendline can be found just slightly above it. Following a failed attempt of breaking above the trendline this morning, the index may be set to pull back towards recent lows and continue downward move. The near-term support to watch is the aforementioned 34,550 pts area. On the other hand, if the index manages to break above the downward trendline, bulls may target 34,840 pts area, where the 38.2% retracement and the upper limit of the Overbalance structure can be found. Index may become more volatile by the end of the US cash session today as a large number of stock and index derivatives are set to expire.

+35726030417

+35726030417 support@Forextk.com

support@Forextk.com Android app

Android app