- Indices from Asia-Pacific traded mixed today. Nikkei gained 0.5% while S&P/ASX 200 dropped 0.3%. Liquidity was thinner due to market holidays in China and South Korea

- US and European index futures dropped at the start of a new week but have recovered the majority of the drop since. DAX futures trade around 150 pts below Friday’s cash close

- Telegraph reports that vote on cutting UK income tax rate for high earners from 45 to 40% will be postponed until sources of financing are presented in budget in late-November

- BBC reports that whole idea of tax cut for high earners may be dropped

- S&P maintained ‘AA’ rating on the UK debt but changed outlook from “stable” to “negative”

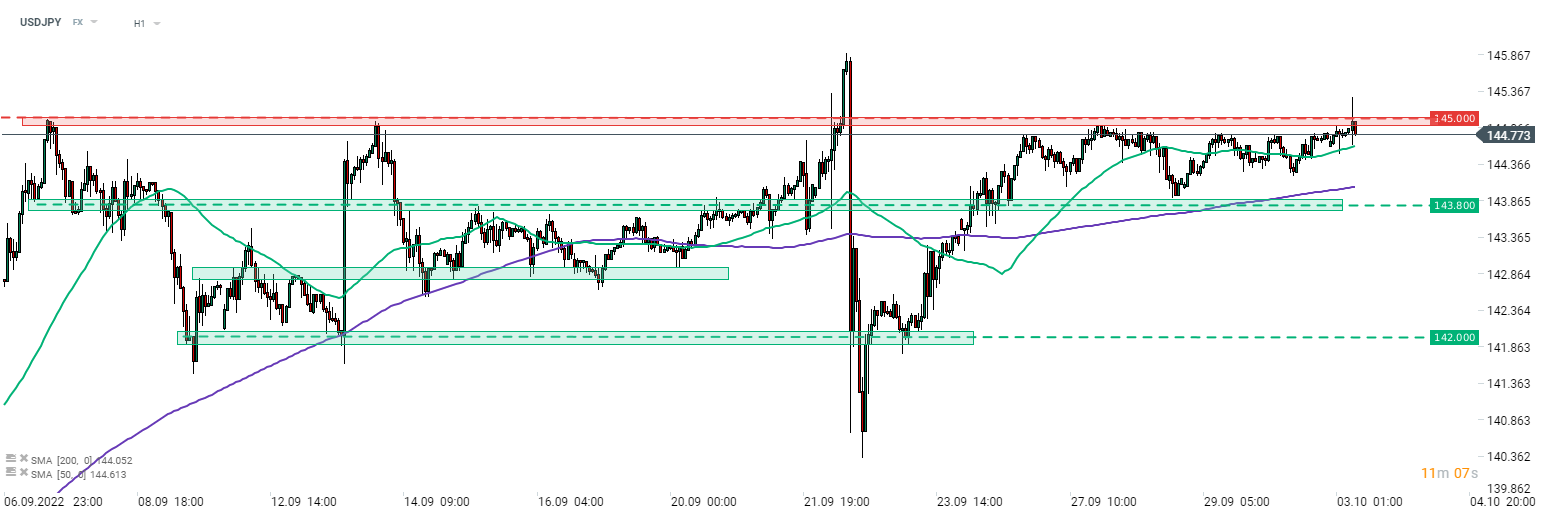

- Japan’s finance minister Suzuki repeated that authorities are monitoring FX moves and will respond if necessary. USDJPY jumped above 145.00 today, a level that trigger intervention two weeks ago

- Oil is trading higher at the beginning of a new week amid media chatter that OPEC+ may cut output this week by 1 million bpd or 1.5 million

- Precious metals gain as the US dollar rally is taking a pause this morning. Gold and platinum gain 0.2% while silver is rallying 2%

- AUD and NZD are the best performing major currencies while JPY and USD lag the most

- Cryptocurrencies are pulling back. Bitcoin trades 0.2% lower, Ethereum drops 0.7% while Ripple slides over 4%

USDJPY jumped above a key 145.00 resistance zone this morning, leading to a verbal intervention from finance minister Suzuki. The pair pulled back slightly since but remains near recent highs.

USDJPY jumped above a key 145.00 resistance zone this morning, leading to a verbal intervention from finance minister Suzuki. The pair pulled back slightly since but remains near recent highs.

+35726030417

+35726030417 support@Forextk.com

support@Forextk.com Android app

Android app

Leave a Reply

Want to join the discussion?Feel free to contribute!