-

Indices from Wall Street continued to gain yesterday. S&P 500 gained 0.28%, Dow Jones moved 0.11% higher and Nasdaq added 0.23%. Russell 2000 lagged and finished trading 0.82% lower

- Stocks in Asia-Pacific traded mostly lower today. Nikkei dropped almost 1%, Kospi moved 0.2% lower and indices from China traded 0.3-1.6% lower. S&P/ASX 200 added 0.5%

- DAX futures point to a flat opening of the European cash session today

- Chinese Vice Premier Sun Chunlan said that more decisive actions against Omicron and Delta are required in Chinese virus hotspots

- According to prepared text of the speech, Fed’s Brainard will tell US lawmakers today that inflation is too high and bringing it back towards the goal is an important task

- Fed’s Daly said that part of policy accommodation needs to be removed. Daly also said that she supports beginning of rate hike cycle in March

- Fed’s Bullard said that 4 rate hikes this year are likely. Fed’s Harker said he is open to more than 3 rate hikes in 2022 if situation requires it

- Maersk, one of the largest shipping companies in the world, warned that global ports remain congested. However, situation in European ports is said to be improving

- Cryptocurrencies continued recovery yesterday with Bitcoin climbing above $43,000

- Precious metals and oil trade lower

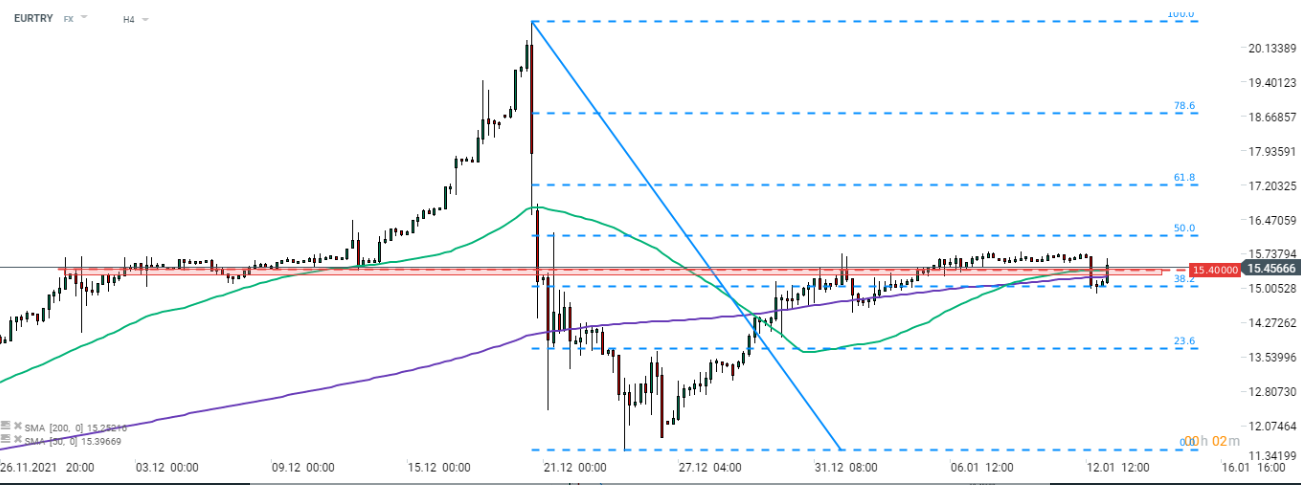

- Turkish lira drops over 2% against USD and EUR

- NZD and JPY are the best performing major currencies while CHF and EUR lag the most. Overall, ranges o

+35726030417

+35726030417 support@Forextk.com

support@Forextk.com Android app

Android app