The New Zealand dollar is rallying against other major currencies today. Antipodean currency gains following release of stellar quarterly jobs data for the second quarter of 2021. Employment increased 1% quarter-over-quarter while the market expects an increase of 0.7% QoQ. Unemployment rate plunged from 4.7% to 4% (exp. 4.5%). The data strengthens the case for a rate hike from the Reserve Bank of New Zealand. Major Antipodean banks – ANZ, ASB, KiwiBank, Westpac and Westpac – now expect RBNZ to deliver 25 basis points rate hikes at each of the three coming meetings (August 18, October 6, November 3). Interest rate derivatives market prices in a 30 basis points tightening in August and a 30% chance of 50 basis points rate hike this month.

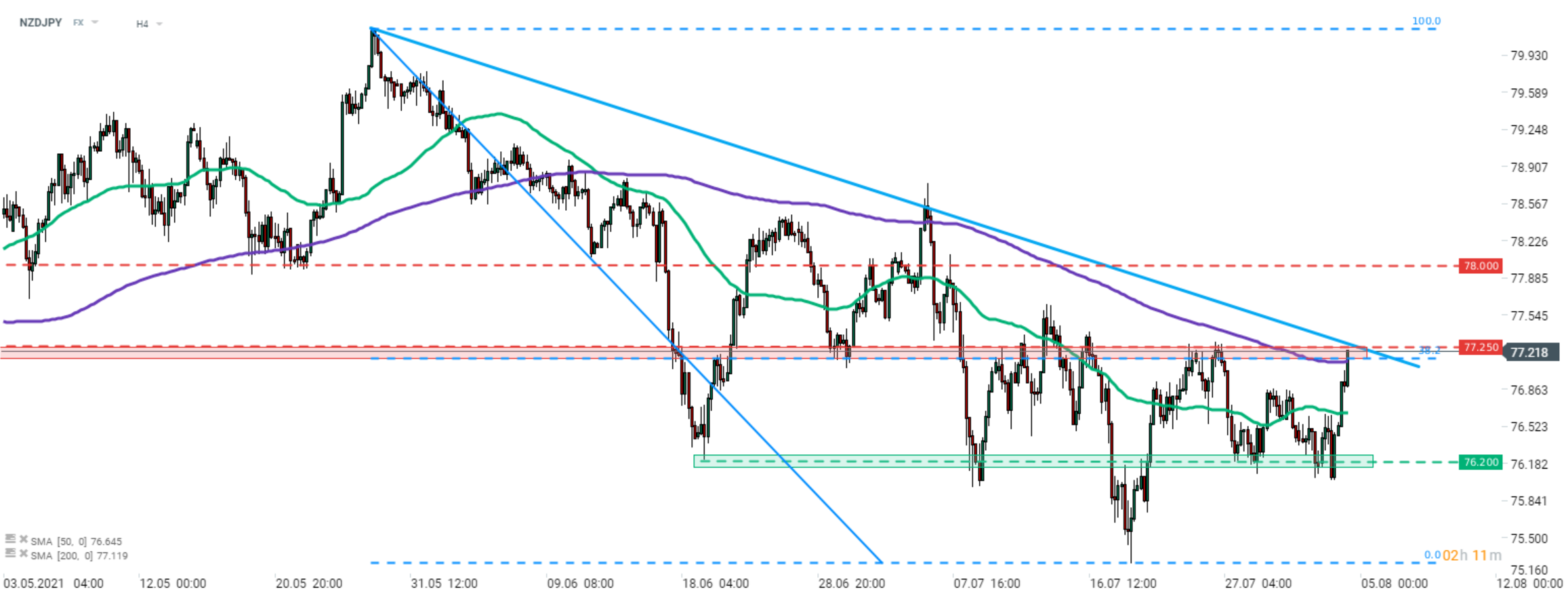

Taking a look at the NZDJPY chart, we can see that the pair has reached an important resistance zone. Area ranging below 77.25 handle is marked with the 38.2% retracement of a downward move launched in May 2021, 200-period moving average (H4 interval, purple line) and downward trendline. In case bulls manage to push the index above this resistance area, a way towards the next major resistance – 0.7800 mark – will be left open.

+35726030417

+35726030417 support@Forextk.com

support@Forextk.com Android app

Android app