-

US indices finished yesterday’s trading lower. S&P 500 dropped 0.09%, Dow Jones moved 0.30% lower and Russell 2000 declined 0.58%. Nasdaq gained 0.16%

- Situation during the Asian trading session was mixed. Nikkei and S&P/ASX 200 gained while Kospi and indices from China dropped

- DAX futures point to a flat opening of the European cash session

- Fed’s Rosengren said that Federal Reserve should annonce taper in September and begin it later this year

- People Bank of China said that the jump in producers’ inflation is temporary.

- China’s Daily reported that PBOC may have to cut reserve requirement ratio or interest rates in order to stimulate growth

- China reported the highest number of new Covid-19 cases since the beginning of a year. New cases in Australia’s New South Wales have hit a record high

- Japanese media report that Prime Minister Suga may seek another stimulus package, this time worth around $270 billion

- Bitcoin climbed above $45,000 mark

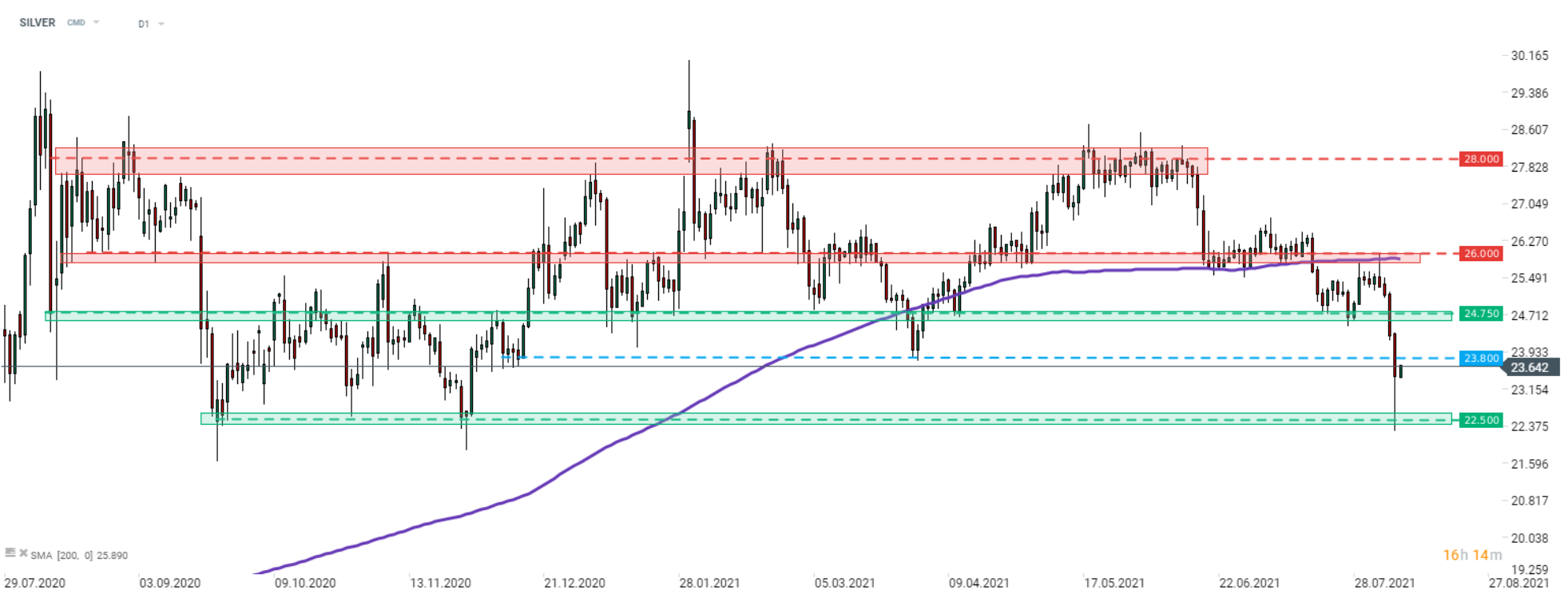

- Gains can be spotted all across the commodity markets. SIlver trades 1.5% higher while oil gains almost 1%

- EUR and GBP are the best performing major currencies while NZD and CHF lag the most

Trade Responsibly. CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 73% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

Forextk LTD does not provide services to residents of the USA, Japan, Canada, Australia, the Democratic Republic of Korea, European Union, United Kingdom, Iran, Syria, Sudan and Cuba.

+35726030417

+35726030417 support@Forextk.com

support@Forextk.com Android app

Android app