US indices traded mostly higher yesterday. S&P 500 gained 0.36%, Dow Jones moved 0.23% higher and Nasdaq added 0.35%. Russell 2000 dropped 0.79%

Upbeat moods could be spotted during the Asian session as well. Nikkei jumped 1.3%, S&P/ASX 200 traded 0.7% higher and Kospi gained 2.0%. Indices from China traded up to 1.0% higher

DAX futures point to a higher opening of the European cash session today

FOMC minutes showed that Fed sees possibility of an even tighter monetary policy if inflation stays at elevated levels

Bloomberg reports that United States and its allies are discussing capping Russian oil price in the $40-60 range

Beijing authorities announced that citizens who want to use in-person sports centers or entertainment venues will have to be vaccinated. A big jump in new Covid cases was reported in Shanghai

API report pointed to a 3.82 million barrel build in US oil inventories (exp. -1.1 mb)

Cryptocurrencies are trading mixed, although the overall scale of moves is relatively small. Bitcoin drops 0.3% while Ethereum gains 0.4%

Energy commodities trade slightly higher. Brent and WTI gain around 0.8% each, with Brent climbing back above $100 per barrel

Precious metals gain with silver being a top performer (+0.8%). Gold and platinum trade 0.5% higher

AUD and NZD are the best performing major currencies while USD, CHF and JPY are top laggards

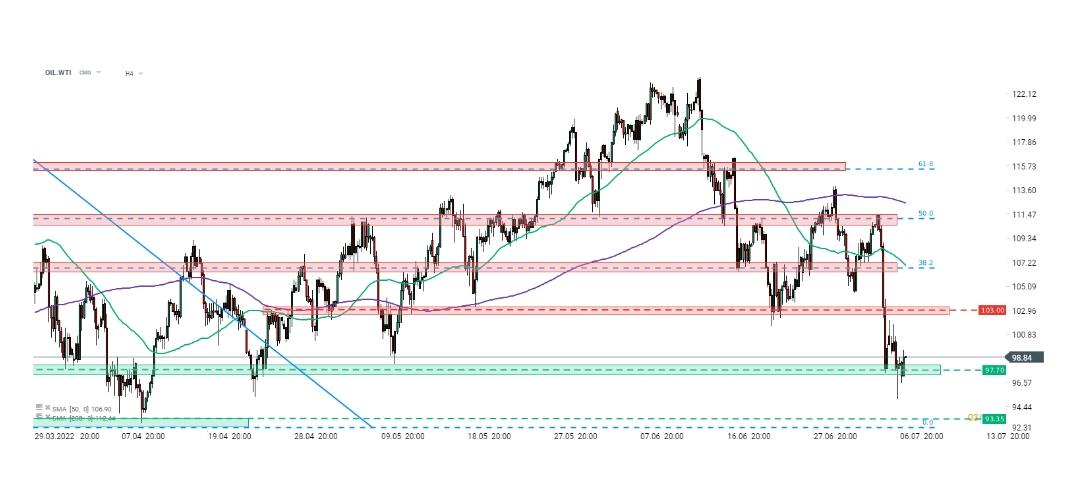

Oil halted recent sell-off but bulls struggle to launch a bigger recovery move. Taking a look at the WTI (OIL.WTI) chart, we can see that an attempt to launch such a move from the $97.70 area is made but the recovery lacks momentum.

+35726030417

+35726030417 support@Forextk.com

support@Forextk.com Android app

Android app